Addressing universal energy access and increasing resilience to climate change through AI: the ElectriFI & Nithio collaboration

There is an urgent need to scale financing to renewable energy solutions to achieve universal energy access and increase resilience to climate change, especially in developing countries and emerging markets. African countries have contributed less than 3% to global emissions, yet African households, smallholder farmers, and microentrepreneurs face outsized impacts from shifting seasons and extreme weather events.

Together, Nithio, an AI-enabled clean energy financing platform, and EDFI ElectriFI, an EU-funded impact investing facility with a mandate to invest in early-stage private companies, have partnered to address this challenge.

Nithio’s Chief Data Scientist, Madeleine Gleave, and EDFI ElectriFI’s Investment Associate, Guillaume Cruyt, discuss how the two organisations have worked together, leveraging Nithio’s data-driven approach to inform and scale sustainable clean energy investments across Africa.

How did Nithio and ElectriFI cross paths?

Guillaume Cruyt: “EDFI ElectriFI’s investment scope, focused on new/improved electricity connections as well as on generation capacity from sustainable energy sources in emerging markets, brought us close to numerous solar pay-as-you-go (PAYGo) companies and projects and confronted us with some of the sector’s shortfalls, among which are differing metric definitions and formulas, access to data, and data granularity.

Back in 2020, when we committed to providing long-term finance to Nithio, our team was impressed by the data science services the company was able to provide to SHS operators, allowing them to access cheaper capital and better allocate it.

Today, we are ourselves benefitting from Nithio’s services. Their innovative approach combining geospatial data, consumer repayment data, AI, financial modelling, and deep industry expertise to standardise credit risk allows us to flag up areas of concern and adapt our financing instruments accordingly.”

How has the relationship evolved?

Madeleine Gleave: “Nithio is very grateful to have found such a strong partner in EDFI ElectriFI, because we know they’re dedicated to moving the off-grid solar sector forward. We’re both aligned in using a data-driven approach, and both recognise that a key barrier to scale is around credit risk.

Our work together started with EDFI ElectriFI’s investment in Nithio’s lending arm, the Nithio FI. Their engagement with the Nithio FI continues to provide valuable feedback on how to continue to maximise impact, especially in our lending to small and mid-sized solar companies.

When Nithio launched our Software as a Service (SaaS) product, the Portfolio Portal, we knew ElectriFI would also provide integral feedback on how we can deliver our analysis in the most useful way, by fitting into the investment team’s workflows and adding new visualizations or features centered around our standardised credit risk assessment. To date, we’ve worked with ElectriFI on three transactions, all delivered through the Portal.”

Prior to working with Nithio, what are the challenges you faced throughout the investment process?

Guillaume: “The solar PAYGo industry is a tricky business to wrap your head around. When investing in such companies, you want to understand the historical and current health of the company’s portfolio and the future cash flows that will derive from it. The challenge is that:

- Even with a clear idea of the metrics you wish to see, it is difficult to access data that is uniform and comparable, and

- Projecting the amounts and the timing of an existing portfolio’s future cash flow is a complex exercise requiring deep analysis of historical data.”

How did your data-driven approach help to solve these challenges?

Madeleine: “For all investors, there’s a level of validation or cross-referencing they are looking for in the information that’s being shared by a potential investee. Investors want to be sure they’re ‘speaking the same “language’ on the portfolio data. That’s the goal of Nithio – to translate and standardise but also to augment insights on portfolio performance and value using our unique AI approach.

EDFI ElectriFI has many portfolio companies, each with different contexts and data systems. ElectriFI had already taken steps to standardise reporting, but it required portfolio companies to self-report and fill out a template on a frequent basis, and even then, there was a lot of room for interpretation. Nithio’s direct integration to the operators’ data systems, combined with reliably standard definitions and formulas, helped reduce the reporting burden and confidence for everyone.

Nithio helps answer core questions around portfolio value, historical trends, and future cashflows – starting at the end-user level and aggregating upwards, so we can offer more flexibility and specificity in insights and breakdowns.”

How does Nithio’s platform help reduce risk and increase SME’s bankability?

Guillaume: “Nithio’s ability to directly connect to a company’s CRM allows accessing granular data to be processed as required. The access enables Nithio to control the formulas and thresholds used to present metrics, thereby reinforcing their uniformity and comparability. Additionally, it allows them to build reliable portfolio cash flow projections by using their AI-enabled solution on historical data. Such features coming from a trustful third party are becoming a critical tool when assessing the bankability of Solar PAYGo companies. Beyond bankability, it helps better match a company’s capital needs to the right investing instrument.”

How does the platform add value to a company looking for additional funding? What does it require?

Madeleine: “Nithio’s standardised credit risk assessments help companies understand and track their operations and overall improve their bankability. While Nithio supported EDFI ElectriFI’s due diligence process, we make sure in all of our engagements to share the Portfolio Portal dashboard with the distributor as well. This provides both the investors and the distributors with:

- Standardised credit risk assessment done by a third party, rather than by the distributor themselves

- Geospatial data visualisations, highlighting areas of high or low performance and especially growth/market potential

- Drilling down on performance by different product types or customer cohorts

- One central place for all their investors to understand portfolio performance and streamlined reporting”

What are your ambitions and upcoming milestones?

Madeleine: “On the product side, Nithio continues to build out our data visualisations, to make our standard metrics clearer and more meaningful for all our users. We are also extending our AI modelling to be even more detailed on cashflow projections and other KPIs.

Additionally, we continue to incorporate feedback from distributors to make sure the Portal provides insight on how to optimise their operations, flag areas for potential growth, and highlight high performance so it can be scaled.

At the end of the day, we hope Nithio will be a central platform for all operators and investors to be able to structure smarter financing, streamline reporting, and scale up their lending and operations with greater data insights. We’re really excited to continue working with EDFI ElectriFI and others in that effort.”

Case study

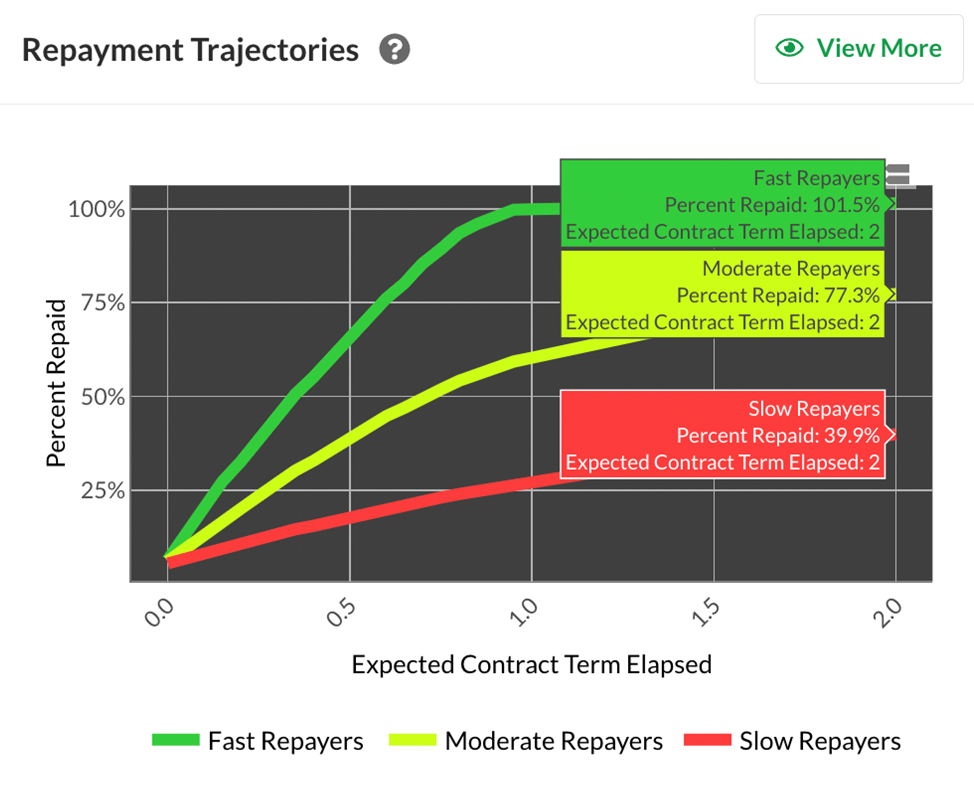

Structuring or restructuring debt in the solar PAYGo industry can be hazardous. It implies gaining comfort in a company’s financial metrics, understanding its future cash flow projections, and having the capacity to monitor them. Nithio has proven itself to be a valuable partner in overcoming these hurdles. Their dashboard includes a table forecasting the expected monthly payments of the existing portfolio, which enables to structure or restructure debt payments accordingly:

Since their dashboard allows for instant updates on a company’s portfolio, the monitoring is timely and convenient, which comes in handy when unexpected events occur. In addition, the risk of ambiguous information is significantly reduced through Nithio’s ability to extract and compute financial covenants independently. Nithio also tracks impact, disaggregated by factors such as gender and location. Their data-driven approach to structuring, restructuring or monitoring debt has and is expected to continue supporting EDFI ElectriFI as a key stakeholder in the PAYGo industry.

Share

Our new investments